This article describes how to create payment runs or royalties reports.

Recommended reading

- Linking files to suppliers

- Invoice payment runs

- Job server

- Importing sales data from agencies/distributors

General information

Payment runs are executed as a background process on the server to minimise impact on the client facing website. You can schedule a payment run with the Job server function that you can find in Back office. Payment runs can be configured to collect all sales data for an affiliate agency sales report, and/or for individual suppliers that you represent. The process collects all invoice details that are marked as “payable to the supplier”. Whether or not a specific invoice detail will be part of a payment run depends on the following:

- the total payable amount for the supplier is not less than the “Lower limit” supplier setting

- the supplier’s last payment was longer than x months ago (supplier’s payment periodicity setting) *

- the supplier has not been paid yet, and invoice details are marked payable longer than x months ago *

- the invoice detail was either marked payable before the processing date that you specify, or its invoice date lies before your processing date (depending on the settings that you configure)

* If a supplier’s payment periodicity is 0 months then a supplier’s sales records will be part of any payment run, regardless of how long ago he/she was last paid. You can furthermore use the job server option “Ignore supplier payment periodicity settings” to include sales records from all suppliers regardless of their periodicity setting or when they have last been paid. This and other options are explained in the following paragraphs.

Setting up a supplier group for an affiliate agency payment run

The supplier group for which you are going to schedule a payment run must be linked to a user account. This user account provides the address, tax and banking details for your agency reports. To set this up, first create the user account if you haven’t already. Then go to Supplier management and open the supplier group properties. You can now select and link the user account to the supplier group on the properties tab sheet.

Using sales reports as “Self billing invoices”

The payment run function generates payment reports that are sequentially numbered. If you create a payment run for an affiliate agency then a single number is created. Payment runs for suppliers will generate a unique number for each supplier/contributor. This report number can be printed as an invoice number, which makes it possible to use these reports as so called Self billing invoices that you can send to your suppliers (photographers) or agents that you represent. You can of course print all the required information on the reports, such as VAT/Tax registration numbers, banking details and so on. Read the paragraph about configuring the sales report for further information.

About printing VAT / Tax on the reports

If you want to print VAT / Tax on your reports, then you need to take note of the following: whether or not VAT / Tax will be printed for a particular supplier is determined by the setting “Print VAT on statements” (in the supplier properties dialog). If this setting is off, no tax is printed on the report for this specific supplier. If this setting is on, tax will be printed based on the selected Tax code. To change this, open the supplier properties dialog and click on the Royalties tab. This is also where you can configure the default commission percentage, the minimum amount threshold (e.g. don’t include in payment run unless the amount is larger than 100 Euro), and how often you want to pay this supplier. So the VAT settings on this tab sheet are not the same as the settings regarding tax that you can find in the user dialog (linked to the supplier). The tax registration number and banking details however, are taken from the linked user record. Note that you can change settings (e.g. the tax settings) for all the suppliers in a group by opening the group dialog in Supplier management, where you’ll find buttons to apply specific settings to all suppliers.

Configuring the sales report

A payment run will generate a PDF sales report for each supplier/contributor or for the selected agency depending on the type of payment run. Both payment run types use the same report. You will need to configure the sales report first. Go to Site configuration, Sales report settings to change the labels that will be printed, to select which fields you want to print and so on.

Both the address details and the report footer are printed by use of macros (the header text field cannot have macros). For example:

REPORT FOR:

[organisation]

Attention [contactname]

[department]

[street1]

[street2]

[zip] [city]

[state]

{ifabroad:[country]}

{ifsupplier:(Pertains to [supplierid]-[suppliername])}

The codes shown above are between brackets, these codes will be replaced by values. You can also use literal text.

Click on the “show” button next to “valid codes” for an overview of all the macro codes that you can use. If a code exists on its own line and it has no value, then the entire line will be skipped. E.g. considering the above example, if the field “department” is empty then the line for “street1” will automatically move up one line.

The {ifabroad:[country]} condition is used to print the country only if the country is not the same as your country (as defined for your website).

The {ifsupplier:…} condition is used to print the information only on reports for supplier payment runs (as opposed to payment runs for affiliate agencies).

Note that the address, tax, and banking details for supplier sales reports are taken from the supplier user accounts, and those details are taken from the user account linked to the supplier group for affiliate agency payment runs.

You can schedule a payment run and when it’s done you can go to Supplier payment runs in back office to view and/or generate the PDF, so that you can see how your settings affect the layout of your report. If you open two browser windows or two browser tabs, then you can easily change the report settings in one window and generate the PDF again in the other window without having to go back and forth between the pages in a single browser window. You can make changes to the sales report settings and generate the PDF again until your happy with the results.

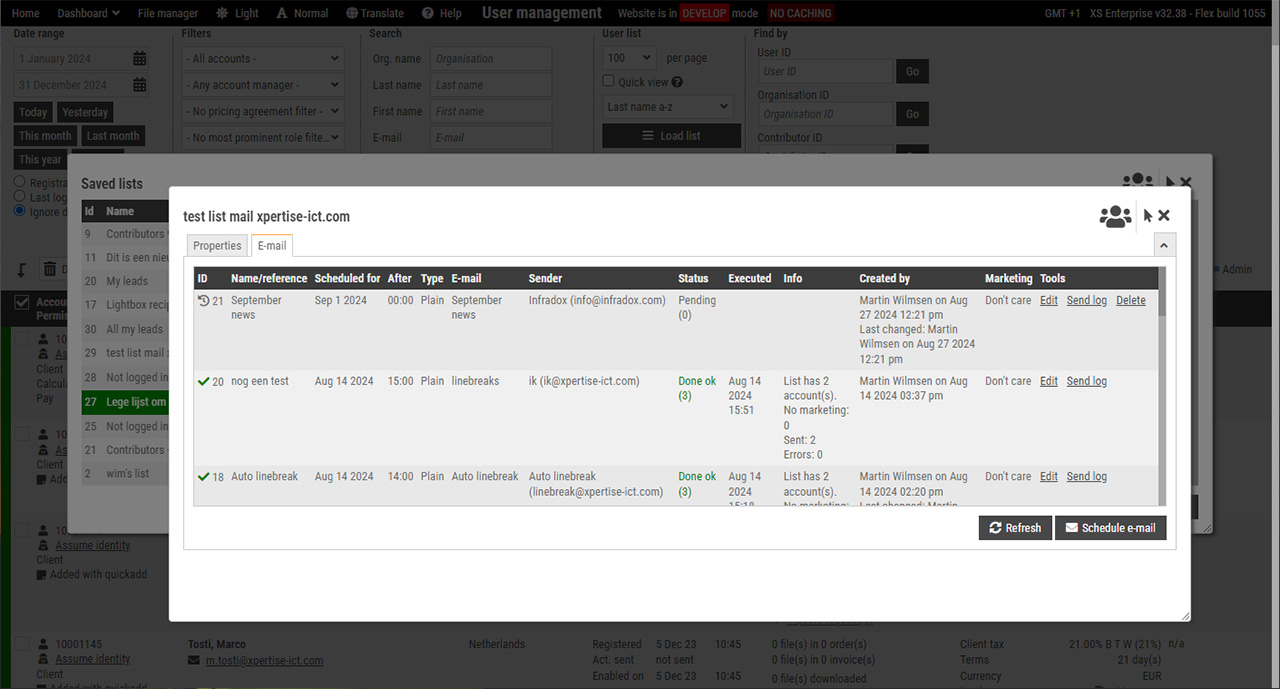

Scheduling a payment run

To schedule a new payment run, go to Site configuration, Job server and add a new job. In the drop down box, select “Supplier payment job”. If you first want to make sure that all paid invoices are also marked as “payable to the photographer”, then go to Invoice management and click on Mark payable in the toolbar. This will open a dialog that lets you check if there still are such invoices and you can automatically mark all such invoices as Payable.

To create a payment run for suppliers/contributors that you represent directly, select the radio button Suppliers next to the label Payment run type. To create a payment run for an affiliate agency that you represent, select the radio button Affiliate agent.

To control which invoice details are included in a payment run, specify the “Invoice or payable date”. Then select a setting in the dropdown box next to the date input:

- Ignore date, include all invoice details

If this option is selected, then all invoice details that are marked as payable and that have not yet been paid – are included - Only invoices before this date

Includes invoice details only if marked payable and if the invoice date lies before the configured date - Only if marked payable before this date

Includes invoice details only if marked payable and if the marked payable date lies before the configured date

Payment runs for suppliers can be limited to a specific supplier group. By leaving the supplier group field empty, the run will include all suppliers in all groups. Payment runs for agents require a supplier group to be selected, and the supplier group that you select must be linked to a user account.

Payment runs for individual suppliers will automatically generate PDF’s. To automatically send the generated PDF’s to the suppliers by e-mail, tick the box “Send PDF’s to suppliers”. If you want to receive all the PDF’s in your own mailbox instead, then untick this box and make sure to enter your e-mail address at the bottom of the dialog. If you don’t want to send PDF’s to your suppliers or yourself, then leave the e-mail address box at the bottom empty. Note that you can download the sales report PDF’s at any time as described in the following paragraph.

Payment runs for affiliate agents will not automatically create or send the PDF sales reports. You can download the reports via Supplier payment runs in the admin menu (see below).

If you want the job to run as soon as possible, then make sure to select the correct day and set the time to “after 00:00”.

Invoice details will be automatically marked as “paid to the supplier” once a payment run has completed.

Viewing payment run details

Once a payment run job has completed. You can view the payment run details via “Supplier payment runs” in the admin menu. The page will list all the completed payment runs.

You can download a csv (excel) file with payment information by clicking on the “Payment list” link in the right most column of each payment run. The csv file has the amounts, tax and banking details. The custom columns that you can use in the supplier records and in the user records are listed as o1 through o10 and u1 through u10 respectively (i.e. o1 is supplier custom1, u1 is user custom1).

To view the details click on the plus icon to expand the view to show all the suppliers/contributors. To then view the details for a contributor/supplier, click on the plus icon in the supplier row.

You will also have access to the generated PDF’s for each of the suppliers (generated by the payment run job). To generate a PDF again, click on the “generate PDF” link.

The overview shows the following links that let you download CSV data:

- Details

Click this link to download a csv file (comma separated values) with details. The last row in this file is a totals row, showing the total net amount invoiced, the total net amount payable (without tax), total tax and the total amount including tax. You can open and edit this file with e.g. Excel or Openoffice Calc and you can send this to your affiliate agent. - Totals

Click this link to download a csv file with totals per supplier. This file doesn’t have details re the invoices and so on. A supplier may appear more than once in the file if he/she has been marked payable with more than one percentage. - Payment list

This downloads a cvs file that you can use to make payments to your contributors. The csv file has all the banking information.

Running a job again

If you want to run a job again, then open its properties (Site configuration, Job server) and click on the “execution info” tab. Check the tickbox “Reset last execution (use this to run this job again)” and save the properties (also make sure to check the run day and time settings).

Deleting a payment run

If you have made a mistake you can complete remove a payment run with the delete link on the right. This will mark all the involved invoice details as “not paid to supplier” again. Note that the seed of the invoice numbering does not change when you delete a payment run. So if the last invoice number for a payment run was 1000, the next number will be 1001 – even if you have deleted 1000 by deleting its payment run.